|

|

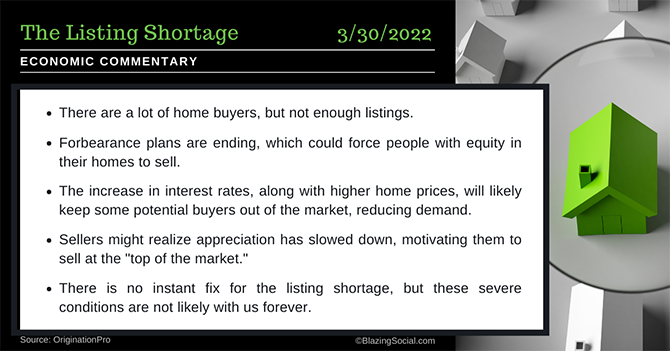

Economic Overview No one predicted the listing shortage would worsen as we get further into 2022.

Real Estate News More than three-quarters of Americans who have a yard say the family yard space is one of the most important parts of their home. Especially during the pandemic, yard uses now include space to perform job-related functions.

Other News

An analysis by First American Financial Corp. economist Ksenia Potapov has found that increased opportunities to work from home may improve homeownership opportunities in a more affordable market. According to Potapov, affordability in the U.S. fell in 2021 on a year-over-year basis, as house-buying power was unable to keep up with red-hot nominal house price growth. The decline in affordability was broad based, as affordability fell in most major markets across the U.S., yet some markets remain more affordable than others for potential first-time home buyers. Affordability for a potential first-time home buyer can be defined as the share of homes for sale that are within the median renter's house-buying power. The amount of house-buying power a renter has relative to nominal house prices in any market greatly influences the supply of homes they can afford. The pandemic, Potapov said, has untethered many workers from their offices, providing some renters the opportunity to pursue homeownership in cities that may be more affordable. Where one lives today is less correlated with where they work, and one study suggests that even once the pandemic wanes, 20% of full workdays will be completed from home. Consequently, the widespread acceptance of remote work has triggered greater interest in relocating to less expensive markets. The pandemic and the ability to work from home have prompted many people to seek more space, as their home is now also their office, gym, and daycare center. If they can't afford a home that fits their needs in their own market, one solution is to move to a market where they can. In the coming years, many workers may leverage their ability to work remotely and their house-buying power to become homeowners in more affordable markets. "As millennials continue to age into their prime home-buying years and the opportunity to work remotely becomes more common, it may be time to update the age-old real estate adage to location, location, re-location," Potapov said. Source: National Mortgage Professional

A survey by one of the leading producers of fiber reinforced cement shows that homeowners are taking severe weather threats seriously and is a driving force on which projects they take up and how much they spend. James Hardie Industries commissioned a survey of 1,000 homeowners from Wakefield Research that is intended to "illustrate the impact of homeowners' concerns about severe weather on their home renovation spending and choices." The survey revealed that 76% of homeowners reported that their renovation plans were influenced by the possibility of extreme weather events. Fifty-four percent of surveyed homeowners responded that just the thought of extreme weather events influenced their decisions about home renovations. "The impact of climate change and severe weather on home design and spending is something we have been closely watching for several years now. Homeowners are looking to protect their homes and their families inside those homes," says Fran Flanagan, Head of Consumer Insights at James Hardie. "As the pandemic continues to give people more time at home, many homeowners are reassessing their properties to determine what needs to be done and in what order." James Hardie's study confirms this trend: 87% of homeowners said they want to continue renovating in 2022." The survey found that millennials completed more COVID-era projects than their Generation X counterparts, or their baby boomer grandparents. In addition, millennials spent much more money than other generations—an average of $40,600 for millennials compared to $10,000 and $11,000 for Gen X and boomers, respectively. Source: MReport |

|

DRE 30303003 BRE 30000000 Sent By Your Company, 5656 Main Street, San Diego CA 98989