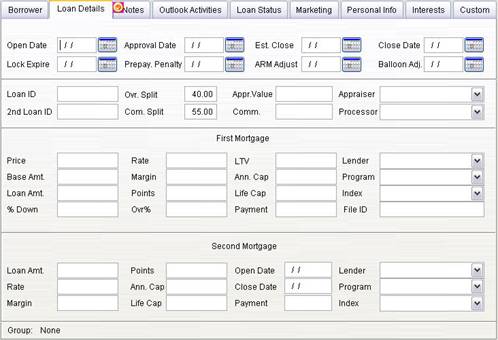

Loan Details Screen

The Loan Details Screen contains fields pertaining to the specifics of the loan, such as interest rates, loan programs, and important dates for monitoring the status of the loan.

Financial Fields

· Open Date - Date loan was opened

· Approval Date-- Loan approval date

· Est. Close - Estimated close date

· Close Date - Actual close date

· Lock Expire - Interest lock date

· Prepay. Penalty – Date there is no longer a prepayment penalty for this loan.

· ARM Adjust – Date the ARM loan will adjust

· Balloon Adj. – Date the Balloon payment is due

· Loan ID - Unique ID to identify the loan

· 2nd Loan ID – Unique ID of the second loan

· Ovr. Split - Overage split with your company

· Com. Split – Commission split with your company

· Appr. Value – Appraised value of the home

· Comm – Commission earned for this loan

· Appraiser - Appraiser of the home

· Processor – The processor for this loan

· Price - Sales price of home

· Base Amt - Base loan amount

· Loan Amt - Amount of loan

· % Down - Automatically created from the sales price and loan amount

· Rate - Loan interest rate

· Margin - Margin applied to adjustable loans

· Points - Points for the loan

· Ovr% - Overage percent applied to this loan

· LTV - Loan to value is automatically created from sales price and loan amount

· Ann. Cap – The annual cap for adjustable loans

· Life Cap - Interest rate lifetime cap for adjustable loans

· Payment - Monthly Payment

· Lender - Lender of the loan

· Program - Type of loan

· Index - Index used in adjustable loans

· File ID – If this loan was imported from another program, this field contains the file or record ID used to create the record

Second Mortgage Fields

The Second Mortgage fields are used for blended loans.

Commission Calculation

Commission is calculated as follows:

Commission = Points x Base Amount x Commission Split + Overage % x Overage Split x Loan Amount

Commission is calculated as follows:

Commission = Points x Base Amount x Commission Split + Overage % x Overage Split x Loan Amount

Commission Split

Enter your commission split with your company. The preset values can be set in the General Preference screen. Select Tools/Options and the General Tab.

Ovr %

This field is the overage amount applied to the loan.

Overage Split

Enter your overage split with your company. The preset values can be set in the General Preference screen. Select Tools/Options and the General Tab.